White-Label

Payment

Solutions

Empowering merchants with customizable, brandable payment software by industry experts

Versatile, Customizable Software for Diverse Industries

Payment Service Providers

Initiate your payment enterprise without upfront investments. Leave the heavy lifting of software development, infrastructure upkeep, and technical support to us.

E-commerce Businesses and Merchants

Venture into new territories, optimize earnings and transaction success rates. Focus on scaling your business while we manage the payment technology for you.

Banks and Payment Acquirers

We offer seamless merchant integration and compliance, customizable payment interfaces, settlement processes, fraud prevention, and extensive third-party integrations.

Online Marketplaces and Platforms

Incorporate financial services within your platform. Tap into new revenue opportunities through integrated payment processing.

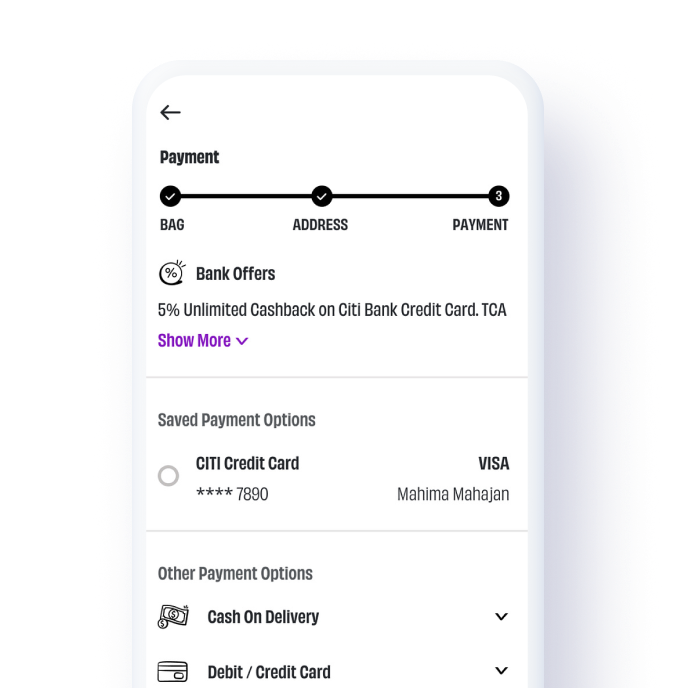

Customize the Checkout Journey for Your Customers

Elevate your brand and exceed customer expectations by personalizing the checkout experience with our customizable payment platform. Our solution allows you to tailor the payment process to match your brand identity, ensuring a seamless and engaging journey for your customers from start to finish. With easy-to-use design tools and a flexible architecture, you can create a checkout experience that not only looks professional but also caters to the unique preferences of your audience.

Intelligent Transaction Routing

Elevate approval rates by directing transactions through the most effective channels.

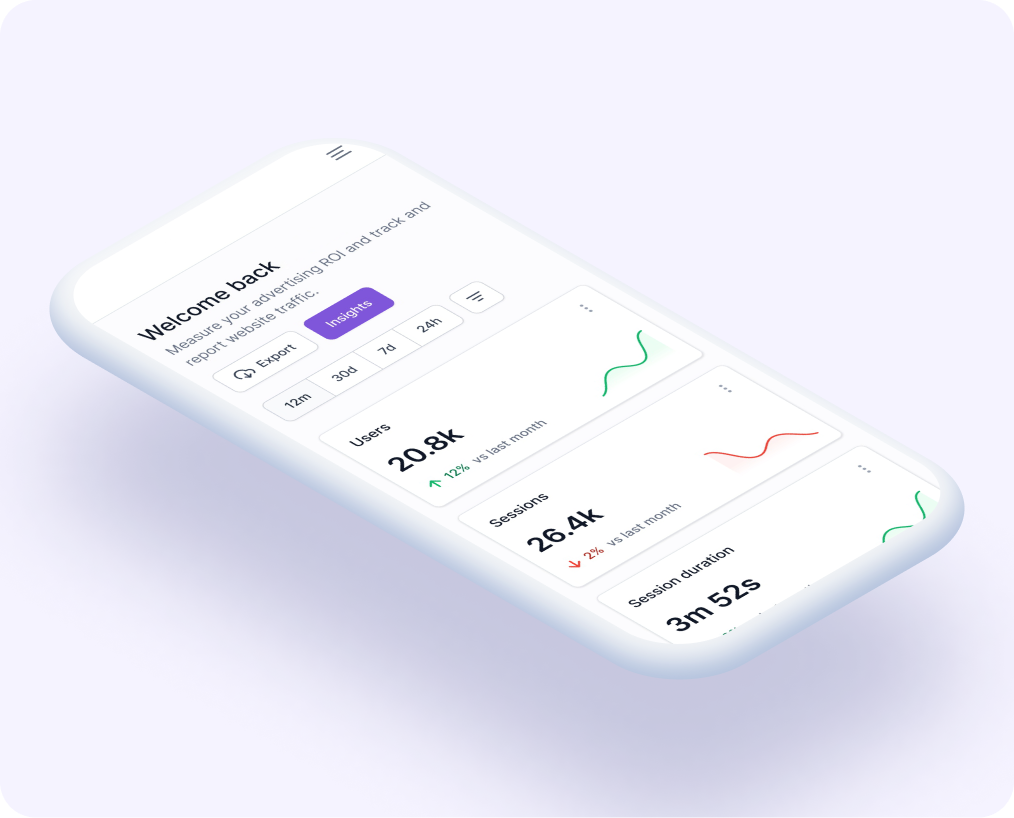

Detailed Analytics Dashboard

Access crucial insights for informed decision-making and comprehensive control over payments.

Dynamic Pricing Strategies

Implement flexible and innovative pricing structures to generate additional income for your merchants.

Enhanced Fraud Protection

Safeguard against fraudulent activities with our in-house anti-fraud system and integration with external providers.

Optimize Your

Payment Experience

Boost transaction success, combat fraud, and master your payment processes with our advanced offerings.

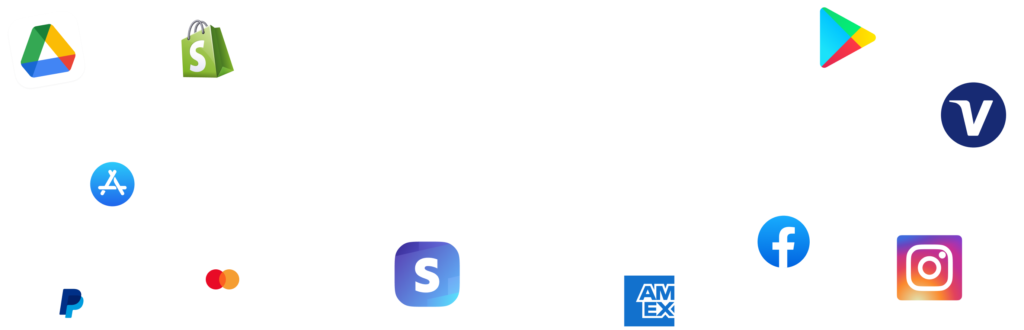

Connectivity with Integrations

Effortlessly link your systems with a wide range of payment integrations, ensuring smooth operations and enhanced compatibility across your payment infrastructure.

Centralize Your Data for Easy Management

Effortlessly aggregate and manage data across multiple payment channels, ensuring complete control and seamless access to your information.

Streamline Your Insights with Advanced Filtering

Easily sift through data using comprehensive filters, enabling pinpoint accuracy in accessing specific information across your payment ecosystem for better decision-making and efficiency.

Comparing Payment Solutions:

In-House Development vs. Modogate

Unveiling the strategic advantages: navigate the differences in efficiency, cost, and speed between in-house development and modogate’s white-label payment solutions

Comparison Criteria

Investment in Development

Speed of Deployment

Operational Expenses

Organizational Complexity

Integration Ease

Compliance Journey

Managing Payments

System Maintenance

Security Against Fraud

Developing Internally

- High initial and ongoing development team costs.

- Slow due to custom development timelines.

- Heavy financial burden for infrastructure setup and maintenance.

- Necessitates a comprehensive team for development, maintenance, and operations.

- Complex and time-intensive for payment integration.

- Lengthy and resource-intensive for achieving PCI DSS and other compliances.

- Requires manual effort or complex automation for payment processing.

- Continuous need for updates, adding to costs.

- Challenging to develop, maintain, and constantly update fraud prevention measures.

Leveraging Modogate

- Economical with scalable subscription pricing.

- Immediate with a market-ready platform.

- Included, offering cost control and efficiency.

- Streamlined with 'complete payment team as a service.

- Simplified with over 400 pre-built payment connectors.

- Simplified, with inherent compliance to PCI DSS and more.

- Features like automatic merchant onboarding and versatile billing solutions.

- Automatically handled, ensuring the platform stays current and secure.

- Built-in advanced security and fraud prevention mechanisms from the outset.